Get the free e stamp form

Show details

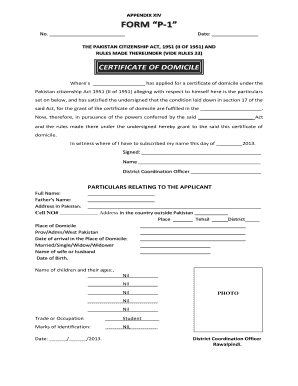

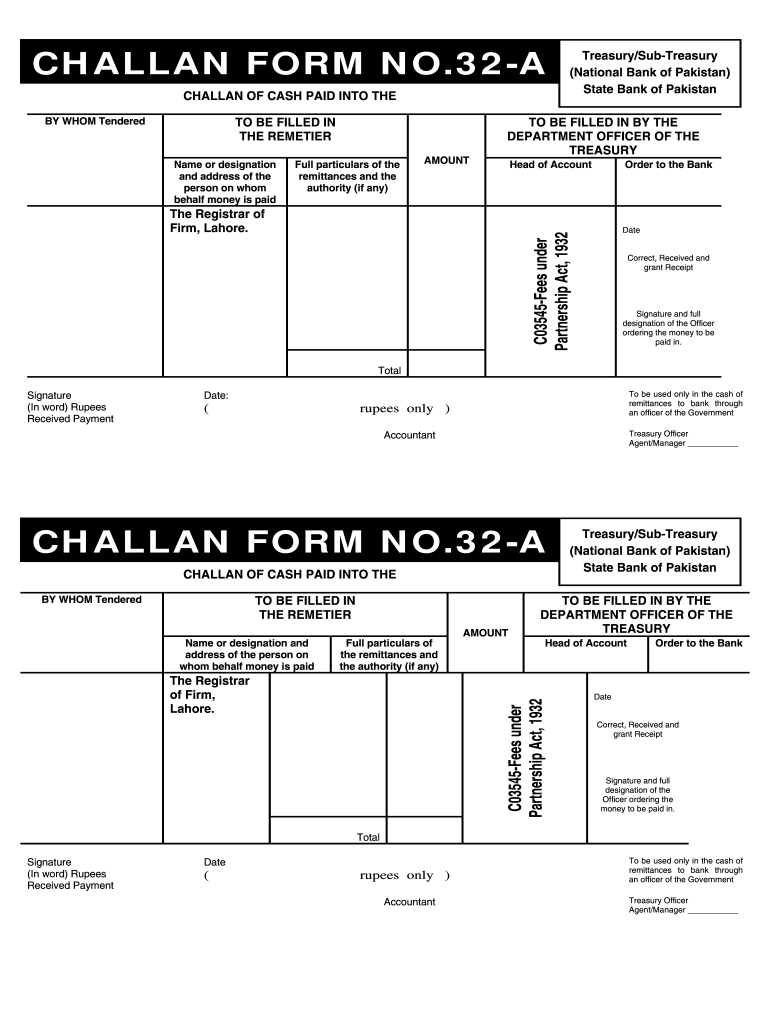

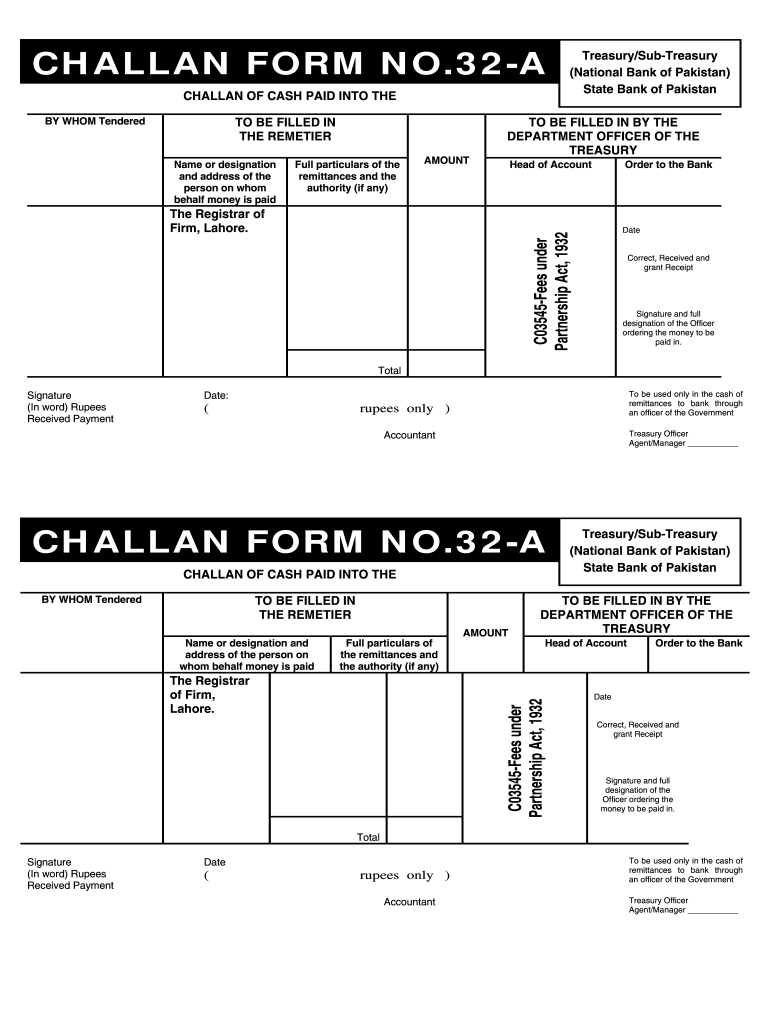

CHALLAN FORM NO. 32-A CHALLAN OF CASH PAID INTO THE BY WHOM Tendered TO BE FILLED IN THE REMETIER Name or designation and address of the person on whom behalf money is paid Full particulars of the remittances and the authority if any AMOUNT Treasury/Sub-Treasury National Bank of Pakistan State Bank of Pakistan DEPARTMENT OFFICER OF THE TREASURY Head of Account Date C03545-Fees under Partnership Act 1932 The Registrar of Firm Lahore. Order to the Bank Correct Received and grant Receipt...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your e stamp form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e stamp form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit e stamp online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit e stamp paper form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out e stamp form

How to fill out e stamp paper?

01

Ensure you have the correct e stamp paper for your specific purpose, as different types of e stamp papers are available for various transactions.

02

Fill in the necessary information, such as the name of the parties involved, their addresses, and the purpose or terms of the agreement.

03

Clearly mention the date on which the e stamp paper is being filled out.

04

Provide any additional details or clauses that may be required based on the nature of the transaction.

05

Once all the required information is filled in, carefully review the document to ensure accuracy and completeness.

06

Sign the e stamp paper at the designated place, and have it witnessed by at least two witnesses.

07

Make the necessary payments for the e stamp paper as per the prevailing rates set by the government.

Who needs e stamp paper?

01

Individuals or businesses involved in legal agreements or contracts often require e stamp papers.

02

Real estate transactions, such as property sale or lease agreements, require e stamp papers.

03

Government agencies and departments may also need e stamp papers for various administrative purposes.

04

Individuals applying for licenses or permits that involve legal documentation may require e stamp papers.

05

Courts, lawyers, and legal professionals may use e stamp papers for drafting legal documents and affidavits.

06

Nonprofit organizations, trusts, and societies may need e stamp papers for registration or filing certain documents.

07

Any individual or entity involved in a transaction that requires legal proof or authentication may require e stamp papers.

Video instructions and help with filling out and completing e stamp

Instructions and Help about challan form 32a

Fill online stamp paper : Try Risk Free

What is challan form 32 a?

CHALLAN FORM NO.32-A Treasury/Sub-Treasury. (National Bank of Pakistan) State Bank of Pakistan. CHALLAN OF CASH PAID INTO THE. BY WHOM Tendered.

People Also Ask about e stamp

How can I stamp my paper online in Punjab?

How to download e stamp paper in Punjab?

How to purchase e stamp online in Punjab?

How can I get e stamp paper online in India?

How to do e-stamping online in Maharashtra?

How to get e stamp paper in Pakistan?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is e stamp online challan?

e-Stamp Online Challan is an online portal developed by the Indian Government to facilitate the payment of Stamp Duty. It is a secure payment gateway which allows citizens to pay stamp duty and other fees online. The portal enables users to make payments through debit/credit cards, net banking, UPI, and other digital modes. This system eliminates the need to visit an offline Stamp Duty Office, which is often time-consuming and cumbersome.

Who is required to file e stamp online challan?

Businesses, institutions, and individuals who are required to pay a fee to the government are required to file e-stamp online challan. This includes filing fees for the registration of documents, stamp duty, court fees, professional tax, and other forms of government fees.

How to fill out e stamp online challan?

1. Visit the official website of the State Bank of India (SBI).

2. Click on ‘e-Stamping’ and select your state.

3. Choose the type of challan you need to fill out.

4. Enter the required details such as name of the payer, date of payment, amount, etc.

5. Select the mode of payment.

6. Upload the scanned copy of the supporting document and click on ‘Submit’.

7. Pay the specified amount using the available modes of payment.

8. Once the payment is successful, you will receive an e-Stamp Certificate.

What is the purpose of e stamp online challan?

E stamp online challan is a secure electronic payment system used for the payment of government taxes and fees. It helps to reduce the time and cost associated with traditional paper-based challan and provides an efficient and secure way to make payments. It also helps to reduce the possibility of fraud and corruption as payments are made directly to the government.

What information must be reported on e stamp online challan?

The information required to be reported on an e stamp online challan includes:

* Payer's name, address, and PAN details

* Payee's name, address, and PAN details

* Challan details such as the purpose of payment and amount

* Taxpayer details such as the GSTIN, if applicable

* Bank details of payment such as account number, IFSC code, and UTR number

* Date of payment

When is the deadline to file e stamp online challan in 2023?

The deadline to file e stamp online challan in 2023 is 31st March, 2023.

What is the penalty for the late filing of e stamp online challan?

The penalty for late filing of an e-stamp online challan is a fine of 10% of the amount due, plus an additional penalty of up to Rs. 5,000.

How can I manage my e stamp directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your e stamp paper form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for signing my e stamp punjab in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your e stamp online and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit e stamp online challan form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like stamp paper online form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your e stamp form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

E Stamp Punjab is not the form you're looking for?Search for another form here.

Keywords relevant to e stamp 32 a challan form

Related to e stamp online challan form sindh

If you believe that this page should be taken down, please follow our DMCA take down process

here

.